Rich vs. Poor Mindset: 4 Key Differences That Shape Your Financial Future

29 APRIL 2025

The Poor Mindset Is More Terrifying Than Poverty

There’s an age-old fable that contrasts the mindsets of two men: one poor, the other wealthy. In a small village, a poor man worked tirelessly every day, but his efforts kept him trapped in poverty. Meanwhile, his wealthy neighbour lived a life of luxury, never needing to lift a finger. Over time, a feeling of resentment began to take root in the poor man’s heart. One day, unable to contain his frustration, he approached God and demanded an answer.

“Why is it that he is rich while I struggle in poverty?” he exclaimed. “It’s not fair! You owe me an explanation!”

God smiled calmly and replied, “I will make him as poor as you are, and I will give both of you a coal mine. What you do with it will be up to each of you.”

When the poor man returned to the village, he saw that his once-wealthy neighbour had become just as poor as he was. A rush of excitement filled him. “With my hard work, I can surely rise above this,” he thought.

The Struggle and the Shift in Perspective

So, the poor man set to work. From dawn till dusk, he laboured in the coal mine, selling what he could in the market. With the little money he earned, he bought food and small treats for his wife and children. Though life improved slightly, it wasn’t enough to escape his poverty.

But the story didn’t end there. The newly-poor rich man, who had never done any physical labour in his life, quickly found the work exhausting. After only a few days, he realised he couldn’t continue like this. Yet, with nothing left to lose, he had no choice but to change his approach.

He began thinking differently. Rather than spending his hard-earned money, he saved it. One day, he saw a group of young men looking for work and seized the opportunity. He hired them to work in the coal mine. Soon, his production skyrocketed.

But he didn’t stop there. Realising that the coal would eventually run out, he reinvested his earnings. He bought several shops and opened a coal processing factory, producing briquettes for sale. His profits soared, and the business also created jobs for others.

The Lesson in Mindset

Three years later, the wealthy man had regained his fortune. Meanwhile, the poor man remained as impoverished as ever. The difference was clear: while the poor man remained trapped in his mindset of scarcity, the wealthy man had learned to think creatively, adapt, and invest in opportunities.

The Mindset That Shapes Wealth

John D. Rockefeller, widely regarded as one of the wealthiest men in history, is often associated with a sentiment that reflects his unwavering confidence in his ability to generate wealth under any circumstances. While there is no direct record of him saying it, a quote commonly attributed to him goes something like this:

“You could strip me of everything, and I’d still find a way to create wealth, because I understand how to seize opportunities.”

This quote reflects the essence of a wealth mindset, the ability to see opportunities even in the most challenging circumstances. But why is it that the rich continue to grow their wealth while the poor often struggle to break free from financial difficulties? The answer lies in their money mindset. As explored in Rich Dad Poor Dad by Robert Kiyosaki, those who build wealth think differently from those who remain financially stuck.

The Wealth Mindset vs. The Poverty Mindset

The term “poor” often refers to those who lack financial resources, but a poverty mindset isn’t exclusive to those with little money. Even high earners can fall into this trap if they fear risk, resist change, or focus only on short-term survival. On the other hand, a wealth-building mindset is often developed through overcoming financial struggles and learning how to make money work for you.

As Vito Corleone famously said in The Godfather, “Great men are not born great; they grow great.” We’re not here to idolise the wealthy or criticise those with less, we’re here to explore how the rich think differently and how these mental shifts can help anyone build financial stability.

Let’s examine the four key differences between a rich vs. poor mindset and see where you align. By understanding these patterns of thinking, you’ll gain insight into why financial success feels out of reach for some while it seems almost effortless for others.

The First Key Difference: How Wealth Is Used

In Rich Dad Poor Dad, Robert Kiyosaki reveals one of the fundamental differences between the rich and the poor:

- The poor work for money.

- The rich make money work for them.

Both groups start from the same place, working hard to earn money. But how they use their earnings sets them apart.

The poor tend to follow a familiar cycle: work, earn, spend, repeat. Their money is often used for consumption, covering bills, buying necessities, or indulging in small luxuries. This keeps them in a loop where they constantly have to trade time for income, never breaking free from financial dependency.

Wealthy individuals, however, prioritise building assets that generate income over time. Whether through investments, real estate, or businesses, they create passive income streams that continue growing, even when they aren’t actively working. This is why the phrase “the rich get richer and the poor stay poor” often holds true, it’s not just about how much money you make but how you manage and multiply it.

The Second Key Difference: Focusing on Your Own Business

There’s a major distinction between having a job and actually owning a business.

Many people, when asked what they do, reply with something like:

“I work in the banking industry.“

But when you ask, “Do you own the bank?” the answer is almost always “No, I just work there.“

This highlights a critical mindset shift: are you working for someone else’s dream, or are you building something of your own? To develop a wealth mindset, you must start thinking beyond just earning a salary.

Ray Kroc’s Unexpected Answer

A great example of this comes from Ray Kroc, the man behind McDonald’s.

During a talk at Texas State University, Kroc asked an MBA class:

“Can anyone tell me what business I’m in?“

The students laughed quietly, wasn’t it obvious? After a moment, one student confidently replied:

“Ray, everyone knows you’re in the hamburger business!“

Kroc grinned and said,

“That’s what I expected you to say. But actually, I’m not in the hamburger business, I’m in the real estate business.“

He went on to explain that while McDonald’s is famous for its burgers, its real wealth comes from franchise locations. McDonald’s Corporation owns the land on which its restaurants are built, making it one of the most valuable real estate companies in the world.

Ray Kroc wasn’t just running a restaurant chain, he was a businessman who created a system where franchise partners operated McDonald’s locations while the company retained ownership of prime real estate.

His success wasn’t about selling fast food. It was about owning the foundation on which those businesses stood.

The Third Key Difference: Wealth-Building Habits

What separates the wealthy from those who struggle financially? It often comes down to habits, the small, daily choices that shape long-term success.

American author Thomas C. Corley spent five years studying 233 self-made millionaires and 128 financially struggling individuals, analysing their habits and life trajectories. His findings revealed a clear pattern:

The rich and the poor both have the same 24 hours in a day, but how they use their free time determines their future.

Out of the 1,440 minutes in a day, most people spend about 1,200 minutes sleeping, working, and eating. That leaves around 240 minutes, a small yet powerful window where habits are formed, shaping two completely different financial outcomes.

The Wealthy Use Their Time Wisely

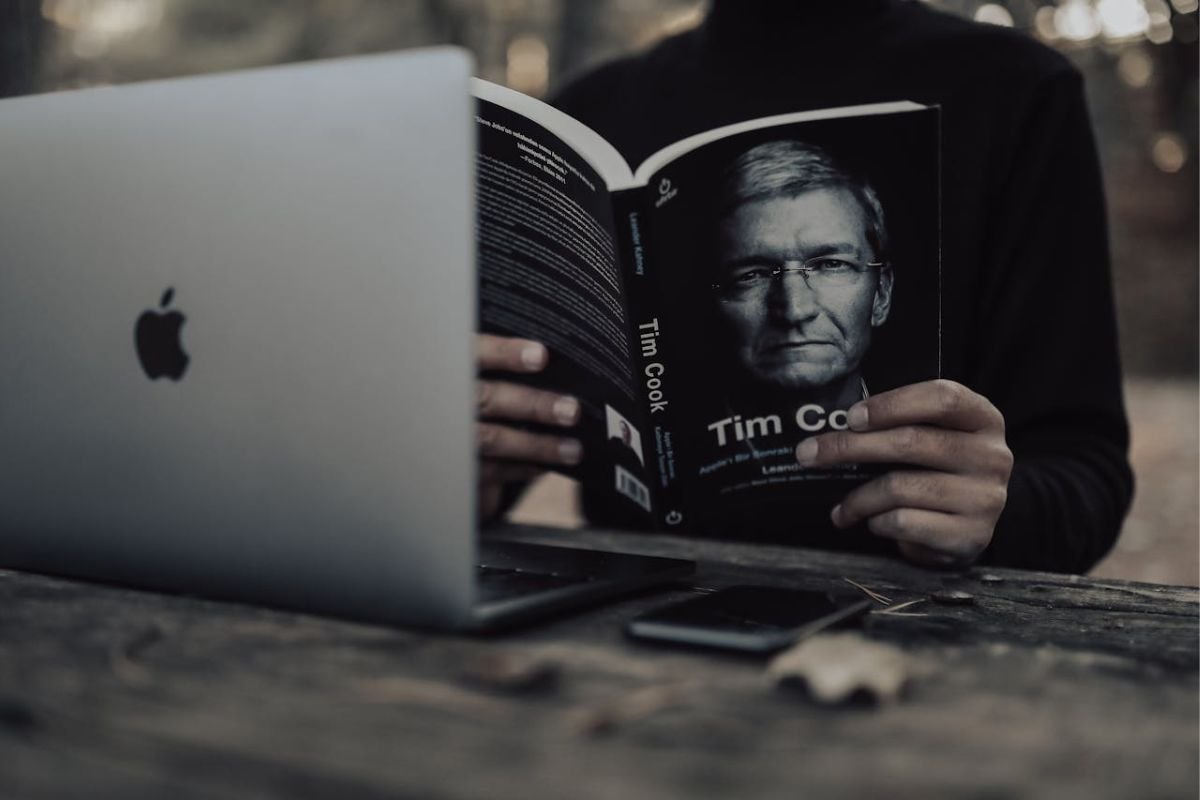

In Rich Habits, Corley found that 88% of wealthy individuals read for at least 30 minutes a day, not for entertainment, but for self-education and personal growth.

Their reading list often includes:

- Autobiographies of successful individuals – Learning from those who have already achieved success.

- Books on personal development – Improving mindset, leadership, and productivity.

- History and other knowledge-expanding subjects – Gaining insights that can be applied to business and decision-making.

Meanwhile, those with a poverty mindset spend their free time on passive entertainment, watching TV, scrolling social media, or engaging in activities that don’t contribute to long-term growth.

The difference? One group invests in their future, while the other lets time slip away.

How Small Habits Can Change a Life

A great example of the power of habit comes from Haruki Murakami, the famous Japanese author.

At 28, Murakami was an unhealthy, chain-smoking writer who barely exercised. Realising that his lifestyle was having a negative impact, he made a simple yet life-changing decision:

- He started running every day.

This commitment, which he has maintained for over 30 years, transformed his physical health and kept his mind sharp, focused, and energised.

Just like Murakami’s daily run shaped his well-being, small, consistent habits determine financial success. Whether it’s learning, networking, or developing new skills, the habits you build today will shape your wealth tomorrow.

The Fourth Key Difference: Giving vs. Gaining

There are no truly “absolute” poor or rich people, except perhaps those who inherit wealth. But when it comes to self-made success, one mindset stands out: understanding the relationship between giving and receiving.

A powerful shift in financial thinking comes from recognising that wealth and generosity go hand in hand. Successful people know that creating value, whether through business, service, or mentorship, attracts more opportunities. They don’t just give for charity’s sake; they give to build relationships, create impact, and, in turn, open doors to even greater success.

In contrast, a poverty mindset is often rooted in scarcity. Those stuck in this way of thinking tend to focus on what they lack, blaming their parents, the economy, or their circumstances instead of seeking ways to change their situation.

The Wealthy Focus on Contribution

Successful individuals don’t just chase money, they create value. They build businesses, provide solutions, and contribute to their industries in ways that benefit others.

Take Elon Musk, for example. His wealth isn’t just a result of luck, it’s the by-product of creating companies like Tesla and SpaceX that push technological boundaries. His focus was never just on making money, but on solving big problems, and in return, wealth followed.

This cycle of giving before receiving is something many successful people understand deeply. They reinvest in businesses, donate to causes, mentor others, and continue learning.

The Poverty Mindset: A Cycle of Blame

On the other hand, many people who struggle financially fall into a cycle of frustration and inaction. Instead of seeking solutions, they:

- Blame circumstances – “I wasn’t born rich, so I’ll never be wealthy.”

- Resent others’ success – “Rich people are just lucky or greedy.”

- Focus on what’s unfair – “The system is rigged against people like me.”

While external factors do play a role, the biggest obstacle isn’t poverty itself, it’s a poverty mindset.

People with this mindset often spend their time calculating every small expense, dwelling on problems, and waiting for opportunities to come to them instead of taking action. This creates a self-fulfilling cycle where they remain stuck, unable to break free from their own mental limitations.

The Real Fear: A Trapped Mindset

The truth is, poverty itself isn’t the scariest thing.

What’s truly frightening is being trapped in a mindset that prevents success, growth, and fulfilment.

While money can be earned, lost, and regained, a negative mindset keeps people stagnant, unable to see opportunities, take risks, or build something greater for themselves.

The key to wealth isn’t just earning more money, it’s thinking differently about how money flows in and out of your life.

By shifting from scarcity thinking (“I need to hold onto everything I have”) to abundance thinking (“The more value I create, the more opportunities will come my way”), true financial freedom becomes possible.

Breaking Free from the Poverty Mindset

Now that we’ve explored the key differences between a poverty mindset and a wealth-building mindset, the big question remains:

How can we shift our thinking and cultivate the habits that lead to financial success?

Breaking free from a limiting mindset isn’t about luck or privilege, it’s about developing the right goals, strategies, and learning habits to create long-term success.

1. Set a Clear and Meaningful Goal

Success doesn’t happen by accident, it starts with a clear vision.

Take Ray Kroc, the man behind McDonald’s global empire. He didn’t just sell hamburgers, he had a vision for something far bigger. His true genius lay in focusing on real estate, not just fast food. By securing prime locations, he turned McDonald’s into a multi-billion-dollar franchise.

But success didn’t come overnight. Kroc’s journey was slow and uncertain at first, yet he pushed forward, knowing that steady progress, even small steps, leads to major results over time.

- Lesson: Don’t get discouraged by slow beginnings. Define your goal, create a plan, and stay consistent.

2. Master One Strategy, Then Diversify

Think of success like baking bread. A skilled baker doesn’t start by trying to master every type of bread at once. They perfect one recipe, ensuring they can make it well, before experimenting with new variations.

Building wealth works the same way.

Most people follow one basic formula: work for money. They get a job, earn a salary, and spend it. That’s what society teaches us.

But those who achieve financial freedom go beyond this. They learn different strategies, investing, creating businesses, building assets, so that their money works for them.

- Lesson: Master one way to earn money, then expand your knowledge to build new sources of income.

3. Learn Quickly and Adapt

In today’s fast-changing world, the ability to learn quickly is more valuable than ever.

Technology, industries, and opportunities evolve rapidly. Those who stay stuck in old ways get left behind, while those who adapt and innovate thrive.

But learning alone isn’t enough. Execution matters. Reading books, watching videos, and gathering information is useless unless you apply it. Successful people don’t just absorb knowledge, they experiment, take risks, and turn ideas into action.

- Lesson: The faster you learn and apply what you know, the faster you’ll grow.

4. Self-Discipline: The Key to Lasting Wealth

One of the biggest factors that separate the wealthy from those who struggle financially is self-discipline.

Think about the countless stories of lottery winners who lose everything within a few years. They come into sudden wealth, yet without financial discipline, their money disappears just as quickly as it arrived. Lavish spending, poor investments, and an inability to say no to instant gratification lead to financial ruin.

If you can’t control your desires, you can’t expect to build long-term wealth.

Wealth isn’t just about making money, it’s about keeping it, growing it, and making smart decisions over time. This requires:

- Delaying gratification – choosing long-term security over short-term indulgence.

- Making tough financial choices – knowing when to save, when to invest, and when to spend.

- Staying consistent – building daily habits that support financial growth.

- Lesson: True wealth-building isn’t about luck or sudden windfalls, it’s about discipline, patience, and making smart choices every day.

5. The Power of Giving: Why Generosity Leads to Success

If you want to receive more, start by giving more.

This principle isn’t just about charity, it’s about creating value in the world. Wealthy individuals understand that giving leads to greater opportunities. They share their knowledge, mentor others, invest in businesses, and support causes that align with their values.

Giving isn’t always about money. It can be as simple as:

- Offering your time to help someone grow.

- Sharing knowledge to uplift others.

- Investing in people and ideas that bring positive change.

This mindset of abundance creates a powerful cycle: the more value you bring to others, the more success and opportunities come back to you.

It is often said that while God needs nothing, humanity is called to give, sharing what we have with others.

Whether you believe in a higher power or not, the message is clear: giving enriches your life far beyond financial success.

- Lesson: When you focus on creating value, the rewards, both financial and personal, will naturally follow.

Final Thoughts: Your Financial Future is in Your Hands

Every time money enters your hands, you face a choice: will you spend it carelessly and stay stuck in financial struggles, or will you invest it wisely in your growth, assets, and future security? Wealth isn’t just about money, it’s about mindset, choices, and the habits you build each day.

The difference between struggling and thriving often comes down to how you think, learn, and take action. Will you keep working for money, or will you learn to make money work for you? Your financial success isn’t determined by luck, it’s shaped by the decisions you make today.

Take advantage of the incredible opportunities available to you. Invest in yourself, shift your mindset, and take control of your financial destiny. And if you found these insights valuable, share them with someone who needs a fresh perspective, because the journey to wealth begins with knowledge and action.

Your future is waiting. Start today.